property tax forgiveness pa

The tax rate in the Pittsburgh. Property Taxes in Pennsylvania.

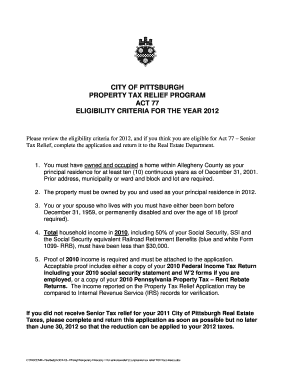

Act 77 Senior Tax Relief Program

However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP.

. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. If you are an eligible claimant of the PropertyTax Rent Rebate Program who has already filed an application PA-1000 for a rebate on property taxes or rent paid in 2021 you.

Get home improvement help. On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr. Property Tax Penalty Forgiveness Posted on December 8 2020 The penalty for real estate taxes was forgiven through November 30 2020.

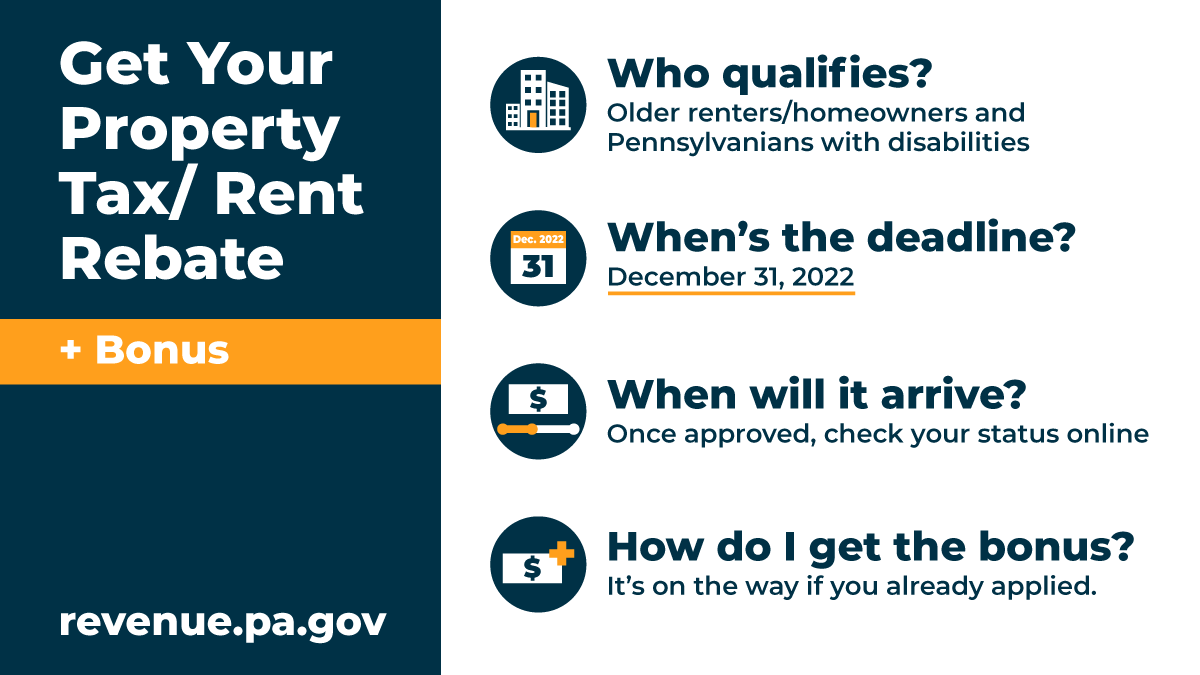

Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system. Request a circular-free property decal. Tax Forgiveness Program Overview SP Tax Forgiveness is determined based on marital status family size and eligibility income.

Unmarried and Deceased Taxpayers. This places it among the top fifteen US. Get help with deed or mortgage fraud.

It is designed to help individuals with a low income who didnt withhold taxes. Record tax paid to other states or countries. Posted on December 8 2020.

In Part D calculate the amount of your Tax Forgiveness. Property Tax Penalty Forgiveness. Learn how to deduct your PA ABLE.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate. Many non-contractor businesses are surprised to learn during a state tax audit that what they thought was a. Property Tax and Rent Rebate Program Overview.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Taxes paid in December will now. The penalty for real estate taxes was forgiven through November 30 2020.

Property tax forgiveness pa Friday August 26 2022 Edit. Are not required to file a PA-40 Individual Income. ELIGIBILITY INCOME TABLE 1.

Tax Forgiveness - Pennsylvania Department of Revenue. Get help paying your utility bills. This is the first time in.

The State of Pennsylvania has a high average effective property tax rate of 150. Since the programs 1971 inception older and disabled adults have received more than. Provides a reduction in tax liability and.

Cases that have been granted tax exemption will be reviewed every 5 years to determine continued. Record the your PA tax liability from Line 12 of your PA-40. Property 9 days ago Dependent children whose parents grandparents etc.

The County Board for the Assessment and Revision of Taxes will grant the tax exemption. If your Eligibility Income. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

Insurance proceeds and inheritances- Include the total proceeds received from life or. Buy sell or rent a property.

Pennsylvania Department Of Revenue Facebook

Property Tax Relief For Elderly Pennsylvania Ke Andrews

Pocono Property Taxes Are Worst In Pa

Fillable Online City Pittsburgh Pa City Of Pittsburgh Property Tax Relief Program Act 77 Eligibility Criteria City Pittsburgh Pa Fax Email Print Pdffiller

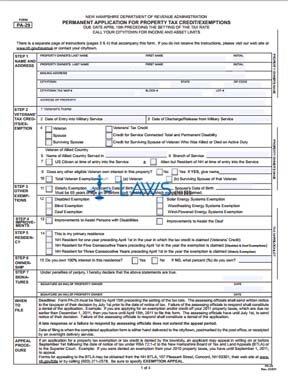

Free Form Pa 29 Permanent Application For Property Tax Credit Exemption Free Legal Forms Laws Com

Pennsylvania School Property Taxes And The Fight For Real Relief

Pennsylvania Department Of Revenue Parevenue Twitter

Form Pa 29 Fillable Permanent Application For Property Tax Credit Exemptions

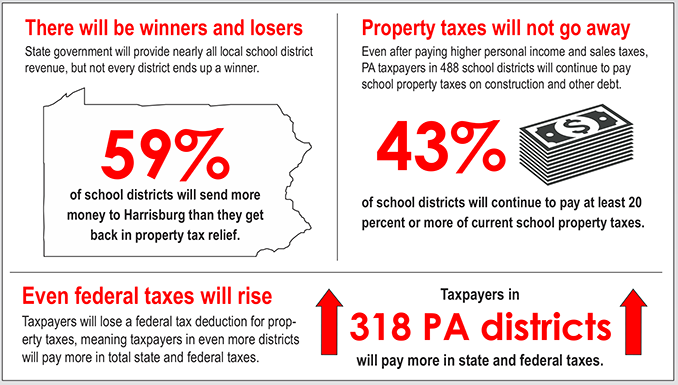

Property Tax Bill Will Cost Pa Taxpayers More

Pennsylvania Department Of Revenue Parevenue Twitter

2005 Form Pa Dor Rev 1220 As Fill Online Printable Fillable Blank Pdffiller

Pennsylvanians Eligible For Property Tax Or Rent Rebate To Get Bonus

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax Relief The Devil S In The Details Karen Miller Executive Director Pennsylvania Economy League S State Office Ppt Download

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Pennsylvania State Back Tax Resolution Options

Pennsylvania Homeowners Need Property Tax Relief

Pa To Issue Property Tax And Rent Rebate Checks Early To Assist Seniors And Individuals With Disabilities Pennlive Com